Objective:

Students will be able to apply mathematics solve financial problems arising in everyday life and justifying solutions (such as income and careers, smart shopping, ways to pay, growing a business, and investing in education).

Students will calculate and interpret a check balance that includes deposits, withdrawals, and transfers. Students will describe and interpret the information in a credit report.

Students will be able to set financial goals, create a helpful budget, create spending plans to support our budget, track their spending, plan for the future.

Focus:

The focus will be to apply mathematics solve financial problems arising in everyday life and justifying solutions, and achieve financial success by spending money carefully, saving regularly, and investing carefully.

Introduction:

This unit seeks to provide the student with the basic skills that allow them to make smart decisions with their money and achieve personal financial stability.

“The number one problem in today’s generation and the economy is the lack of financial literacy”. Alan Greenspan

The students must have a clear understanding of money and how it is spent and saved.

Standards:

TEKS 6.14A, 6.14B, 6.14C, 6.14E, 6.14F

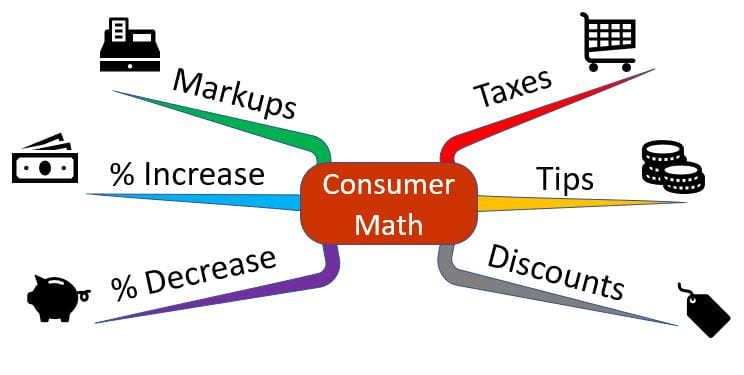

Mind map

Anchor Chart:

Vocabulary:

>>Unit Review ( )<<

I DO… (You Watch):

****

*

*

*

*

*

*

*

*

*

*

WE DO…(Together)

YOU DO… (I watch/guide)

CM04 Change

CM04 Change

CM16 Grocery

CM08 Earning_Money

CM09 Money_Word Problems

PE11 Commission

CM15 Consumer_Math

CM05 Discount

PE09 Markup

PE08 Price_with_Tax

CM18 Retail_Math

PE10 Simple_Interest

PE07 Tax

PE12 Tips

CM01 Unit_Price

CM02 Unit_Rate

CM03 Best Deal

CM06 Discount_1

CM07 Discount_2

CM10 OfficeDepot

CM11 Olive

CM12 Restaurant

CM13 Sales_Tax

CM14 Math_at_Dinner

CM03 Best Deal

Warm-up – Daily Review. Math videos & Skill Builders from my blog (hands-on, online curriculum aligned math worksheets that automatically tracks student progress) (to be completed as homework if not completed in class).

Differentiation:

Accommodations for instruction will be provided as stated on each student’s (IEP) Individual Education Plan for special education, 504, at risk, and ESL/Bilingual.

I will use the KWL approach (What do I Know, What do I want to know, What did I learn) to determine student readiness. Differentiation will be through small groups, visuals, use of calculators, extra time, supplemental aids and reteach if necessary.

Planning:

The student will learn about money and budgeting, and understand how to use math to solve real-world problems related to money.

Performance Indicators:

Students will be able to:

- decide on the best purchase by using unit price.

- calculate sales tax for a given purchase.

- calculate and compare simple interest.

- identify the components of a personal budget.

- create a net worth statement using assets and liabilities.

Essential Questions:

Why do we use money?, What can I afford?, What are the risks of credit and debt?, What are the benefits of having a budget?

Journal:

- What are the career choices that are in demand? How do you get admitted to college and what are the sources for funding college?

- What career fields are growing? Shrinking? Why?

- What are the steps involved in buying a house and how do I determine when I can afford a house?

Closing Product:

Students will be able to solve problems involving check accounts (deposits, withdrawals, and transfers).

Students will be able to solve problems involving credit and interest.

Students will be able to balance a check book.

Students will set (and share) their own financial goals and make plans for the future

6.14A I can compare checking account and debit card offers from different banks.

6.14B I know the difference between debit cards and credit cards.

6.14C I can balance a check register.

6.14D I know the importance of a good credit history.

6.14E I know what information credit reports have and how long it is retained.

6.14F I know how borrowers and lenders use credit reports.

6.14G I can explain various methods to pay for college.

6.14H I can compare the salaries of occupations and know the effects on lifetime incomes.